UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of theSecurities Exchange Act of 1934

(Amendment No. )

Filed by thethe Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Rule 14a-12 |

HMN FINANCIAL INC. | ||

(Name of registrant as specified in its charter) | ||

(Name of person(s) filing proxy statement, if other than the registrant) | ||

Payment of Filing Fee (Check the appropriate box): | ||

☒ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

|

1016 Civic Center Drive N.W.

Rochester, Minnesota 55901

(507) 535-1200

March 21, 201620, 2018

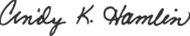

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders to be held at the Rochester Golf and Country Club, located at 3100 W. Country Club Road, Rochester, Minnesota, on Tuesday, April 26, 2016, 24, 2018, at 10:00 a.m., local time.

The corporate secretary’ssecretary’s notice of annual meeting and the proxy statement that follow describe the matters to come before the meeting. During the meeting, we also will review the activities of the past year and items of general interest about our company.

We hope that you will be able to attend the meeting in person, and we look forward to seeing you. Please vote your proxy through the Internet, by telephone or mark, date and sign the enclosed proxy card and return it in the accompanying postage-paid replyreply envelope as quickly as possible, even if you plan to attend the annual meeting. If you later desire to revoke the proxy, you may do so at any time before it is exercised.

Sincerely, | |

| |

Hugh C. Smith | |

Chairman of the Board of Directors |

VOTING METHODS

The accompanying proxy statement describes important issues affecting HMN Financial, Inc. If you were a stockholder of record at the close of business on March 3, 2016,1, 2018, you have the right to vote your shares through the Internet, by telephone or by mail. You also may revoke your proxy any time before the annual meeting. Please help us save time and administrative costs by voting through the Internet or by telephone. Each method is generally available 24 hours a day and will ensure that your vote is confirmed and posted immediately. To vote:

1. | BY INTERNET |

a. | Go to the web site at http://www.proxypush.com/hmnf, 24 hours a day, seven days a week, until 11:59 p.m. central time on April |

b. | Please have your proxy card and the last four digits of your social security number or tax identification number and create an electronic ballot. |

c. | Follow the simple instructions provided. |

2. | BY TELEPHONE |

a. | On a touch-tone telephone, call toll free 1-866-883-3382, 24 hours a day, seven days a week, until 11:59 p.m. central time on April |

b. | Please have your proxy card and the last four digits of your social security number or tax identification number. |

c. | Follow the simple instructions provided. |

3. | BY MAIL (if you vote by telephone or Internet, please do not mail your proxy card) |

a. | Mark, sign and date your proxy card. |

b. | Return it in the enclosed postage paid envelope. |

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record that you must follow in order for your shares to be voted.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder

Meeting to Be Held on April 26, 2016:24, 2018:

The Proxy Statement and Annual Report to Stockholders are available at

http://www.rdgir.com/hmn-financial-inc

Your vote is important. Thank you for voting.

HMN FINANCIAL, INC.

Notice of Annual Meeting of Stockholders

to be held on

April 26, 201624, 2018

Notice is hereby given that the annual meeting of stockholders of HMN Financial, Inc. will be held at the Rochester Golf and Country Club, located at 3100 W. Country Club Road, Rochester, Minnesota, at 10:00 a.m., local time, on April 26, 2016.24, 2018.

A proxy card and a proxy statement for the meeting are enclosed.

The meeting is for the purpose of considering and acting upon:

1. | election of three directors to serve until the conclusion of the third succeeding annual meeting of stockholders or until their successors have been duly elected and qualified; |

2. | an advisory (non-binding) vote for the approval of the compensation of executives, as disclosed in this proxy statement; |

3. |

|

such other matters as may properly come before the meeting, or any adjournments or postponements thereof. As of the date of this notice, the board of directors is not aware of any other business to come before the meeting.

Any action may be taken on the foregoing proposals at the meeting on the date specified above, or on any date or dates to which the meeting may be adjourned or postponed. Stockholders of record at the close of business on March 3, 2016,1, 2018, are the stockholders entitled to receive notice of, and to vote at, the meeting and any adjournments or postponements thereof.

A complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose germane to the meeting, between 9:00 a.m. and 5:004:30 p.m. central time, Monday through Friday, at HMN Financial, Inc., 1016 Civic Center Drive N.W., Rochester, Minnesota for a period of ten days prior to the meeting.

Your proxy is important to ensure a quorum at the meeting. Even if you own only a few shares, and whether or not you expect to be present at the meeting, please vote your proxy by telephone or through the Internet, in accordance with the voting instructions set forth on the enclosed proxy card, or mark, date and sign the enclosed proxy card and return it in the accompanying postage-paid reply envelope as quickly as possible. You may revoke your proxy at any time prior to its exercise, and returning your proxy card or voting your proxy by telephone or through the Internet will not affect your right to vote in person if you attend the meeting and revoke the proxy.

HMN FINANCIAL, INC. BY ORDER OF THE BOARD OF DIRECTORS | |

| |

Cindy K. Hamlin | |

Secretary |

Rochester, Minnesota

March 21, 201620, 2018

PROXY STATEMENT

ABOUT THE ANNUAL MEETING

This proxy statement is furnished in connection with the solicitation on behalf of the board of directors of HMN Financial, Inc. of proxies to be used at the annual meeting of stockholders, which will be held at the Rochester Golf and Country Club, located at 3100 W. Country Club Road, Rochester, Minnesota, on April 26, 2016,24, 2018, at 10:00 a.m., local time, and any adjournments or postponements of the meeting. The accompanying notice of annual meeting and this proxy statement are expected to be mailed to stockholders on or about March 21, 2016.20, 2018.

Certain information provided herein relates to Home Federal Savings Bank, a wholly owned subsidiary of our company referred to as “the bank.”

The board of directors requests that you vote on the proposals described in this proxy statement. You are invited to attend the meeting, but you do not need to attend the meeting to cast your vote.

What is the purpose of the annual meeting?

At the annual meeting, we will ask our stockholders to vote on three matters:

1. | to elect three members of our board of directors, to serve until the conclusion of the third succeeding annual meeting of stockholders or until their successors have been duly elected and qualified; |

2. | an advisory (non-binding) vote for the approval of the compensation of executives, as disclosed in this proxy statement; and |

3. |

|

to transact any other business that may properly be brought before the meeting. Following the formal portion of the meeting, our management will report on our performance and answer questions from our stockholders.

Who is entitled to vote on the proposals to be considered at the meeting and described in this proxy statement?

Common stock is our only authorized and outstanding security entitled to vote on the proposals described in this proxy statement at the annual meeting. In this proxy statement, when we refer to “stockholder,” we are referring to our common stockholders, unless stated otherwise herein. Holders of record of our common stock as of the close of business on March 3, 2016,1, 2018, the record date, will be entitled to one vote for each share of common stock then held. As of March 3, 2016,1, 2018, we had 4,486,2994,504,234 shares of common stock issued and outstanding. The number of issued and outstanding shares excludes shares held in our treasury.

Who is entitled to attend the meeting?

Subject to space availability, all stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Since seating is limited, admission to the meeting will be on a first-come, first-served basis. Registration will begin at 9:30 a.m. If you plan to attend the meeting, please note that you will be asked to present valid picture identification, such as a driver’s license or passport. Cameras, recording devices and other electronic devices are not permitted at the meeting.

Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date.

What constitutes a quorum?

The presence, in person or by proxy, of one third of the outstanding shares of common stock entitled to vote constitutes a quorum for purposes of the meeting. AbstentionsAbstentions and votes withheld will be counted for the purpose of determining the presence of a quorum.

How do I vote?

If you are a registered stockholder, proxies in the accompanying form that are properly signed and duly returned to us, voted by telephone or through the Internet in accordance with the voting instructions set forth below, and not revoked, will be voted in the manner specified. We encourage you to vote by telephone or on the Internet, if possible, to reduce the costs of tabulating the vote.

To vote by Internet:

a. | Go to the web site at http://www.proxypush.com/hmnf. |

b. | Please have your proxy card and the last four digits of your social security number or tax identification number and create an electronic ballot. |

c. | Follow the simple instructions provided. |

To vote by telephone:

a. | Call toll free 1-866-883-3382. |

b. | Please have your proxy card and the last four digits of your social security number or tax identification number. |

c. | Follow the simple instructions provided. |

To vote by mail:

a. | Mark, sign and date your proxy card. |

b. | Return it in the enclosed postage paid envelope. |

If you are a registered stockholder and attend the annual meeting, you may deliver your proxy in person.

If you hold your shares in “street name”,“street name,” meaning you hold them through an account with a bank or broker, your ability to vote over the Internet or by telephone depends on your bank’s or broker’s voting procedures. Please follow the directions that your bank or broker provides.

All shares of our common stock represented at the meeting by properly executed proxies, duly delivered to our corporate secretary prior to or at the meeting, and not revoked, will be voted at the meeting in accordance with the instructions specified on the proxies.

What happens if I return my executed proxy without voting instructions?instructions?

If no instructions are indicated, properly executed proxies will be voted as follows:

• | for the election of each of the three nominated directors; |

• | for the advisory (non-binding) vote to approve the compensation of executives, as disclosed in this proxy statement; and |

• | forthe ratification of CliftonLarsonAllen LLP as our independent registered public accounting |

As of the date of this proxy statement, the board does not know of any matters, other than those described in the notice of annual meeting and this proxy statement, that are to come before the meeting. If any other matters are properly presented at the meeting for action, the persons named in the enclosed form of proxy and acting thereunder will have, to the extent permitted by law, the discretion to vote on thosethose matters in accordance with their best judgment.

May I revoke my proxy or change my vote?

A proxy given pursuant to this solicitation may be revoked at any time before it is voted. Proxies may be revoked by filing with our corporate secretary, at or before the meeting, a written notice of revocation bearing a later date than the date on the proxy. A vote may be changed by duly executing a proxy dated a later date than the earlier proxy and relating to the same shares and delivering it to our corporate secretary at or before the meeting. Attendance at the meeting will not by itself revoke a previously granted proxy.

What is the recommendation of the board of directors on voting my shares?

Our board of directors recommends a vote as follows:

• | for the election of each of the three nominated directors; |

• | forthe advisory (non-binding) vote to approve the compensation of executives, as disclosed in this proxy statement; and |

• | for the ratification of CliftonLarsonAllen LLP as our independent registered public accounting |

If any other matters come up for a vote at the meeting, the proxy holders will vote in line with the recommendations of the board of directors or, if there is no recommendation, at their own discretion.

What vote is required to approve each item?

If there is a quorum at the annual meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

• | Election of Directors (Proposal 1). Directors are elected by a plurality of the votes cast at the meeting, therefore, the three director nominees who receive the greatest number of votes cast by the common stockholders will be elected. For this purpose, a voteagainst one or more director nominees or a properly executed proxy markedabstain with respect to the election of director nominees will be counted for purposes of determining whether there is a quorum, but will have no effect on the outcome of the vote on the election of directors. |

• | Advisory Vote on Approval of Executive Compensation (Proposal 2). We will consider the stockholders to have approved the compensation of our executive officers, on an advisory, non-binding basis, if this proposal receives the affirmative vote of holders of at least a majority of the common stock for which votes are cast at the annual meeting. The advisory vote to approve the compensation of our executive officers is not binding on the board, but the compensation committee of the board will consider the vote of the stockholders when considering future executive compensation arrangements. A properly executed proxy markedabstainor a broker non-vote (discussed in more detail below) with respect to this proposal will not impact the outcome of this vote. |

• | Ratification of Independent Registered |

Generally, for all other items that properly come before the meeting, the affirmative vote of a majority of the common stock for which votes are cast at the annual meeting is required for approval. A properly executed proxy markedabstainor a broker non-vote with respect to any such item will not impact the outcome of this vote.

What is the effect of abstentions and broker non-votes?

If stockholders indicate on their proxy that they wish to abstain from voting on a particular proposal, including brokers holding their customers’customers’ shares of record who cause abstentions to be recorded, these shares are considered present and entitled to vote at the meeting for purposes of determining a quorum, but are not considered present or votes cast for purposes of calculating the vote with respect to that proposal. A proxy markedabstain on Proposal 1, Proposal 2, or Proposal 3 will not impact the outcome of those proposals.

Although our shares of common stock are traded on the NASDAQNasdaq Global Market, we are subject to certain rules and regulations of the New York Stock Exchange, including those relating to the ability of brokers to vote on certain matters. If a stockholder does not give a broker holding the stockholder’s shares instructions as to how to vote the shares, the broker has authority under New York Stock Exchange rules to vote those shares for or against “routine” matters that are not contested. For purposes of this proxy statement, the only “routine” matter is the ratification of CliftonLarsonAllen LLP as our independent registered public accounting firm. Brokers cannot vote on their customers’ behalf on “non-routine” proposals. A “broker non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have or does not exercise discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. If a broker returns a “non-vote” proxy indicating a lack of authority to vote on a proposal, then the shares covered by such a “non-vote” proxy will be deemed present at the meeting for purposes of determining a quorum, but not present or a vote cast for purposes of calculating the vote with respect to that proposal. Therefore, broker non-votes will have no effect on any of the proposals to be voted upon by the stockholders.

May the meeting be adjourned?

If a quorum is not present at the meeting, the chairman of the meeting, or the stockholders present, by vote of a majority of the shares entitled to vote by stockholders that are present in person or represented by proxy, may adjourn the meeting. At any adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the meeting as originally called.

Who pays the expenses incurred in connection with the solicitation of proxies?

We will bear the cost of solicitation of proxies. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of common stock. In addition to solicitation by mail, our directors and officers, as well as employees of the bank, may solicit proxies personally or by telephone without additional compensation.

How may I obtain additional copies of the annual report?

Our 20152017 annual report, including financial statements, is enclosed. The annual report is also available online at www.hmnf.com or www.rdgir.com/hmn-financial-inc. For additional printed copies, which are available without charge, please request copies in writing to 1016 Civic Center Drive N.W., Rochester, Minnesota 55901, Attention: Corporate Secretary.

What is the deadline for submitting a stockholder proposal for the 20172019 annual meeting?

We must receive stockholder proposals intended to be presented at the 20172019 annual meeting of stockholders that are requested to be included in the proxy statement for that meeting at our principal executive office no later than November 21, 2016.20, 2018. The inclusion of any stockholder proposals in the proxy materials will be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including Rule 14a-8. We must receive any other stockholder proposals (including director nominations) intended to be presented at the 20172019 annual meeting of stockholders in writing at our principal executive office no later than 90 days in advance of the meeting (or if we do not publicly announce our annual meeting date 100 days in advance of the meeting date, by the close of business on the 10th10th day following the day on which notice of the meeting is mailed to stockholders or publicly made). We currently anticipate that our 20172019 annual meeting of stockholders will be held on or about April 25, 2017;23, 2019; therefore, we must receive notice of any business to be brought before that meeting by January 25, 2017.23, 2019. Written copies of all stockholder proposals should be sent to our principal executive offices at 1016 Civic Center Drive N.W., Rochester, Minnesota 55901, Attention: Corporate Secretary.

What does it mean if I receive more than one proxy card or instruction form?

This means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please either vote each account over the Internet or by telephone, or sign and return by mail all proxy cards. We encourage you to register all of your shares in the same name and address by contacting our transfer agent, Wells FargoEQ Shareowner Services, at 1-800-401-1957. If you hold your shares through an account with a bank or broker, you should contact your bank or broker and request consolidation.

I share an address with another stockholder, how can I change the number of copies of the proxy statement that we receive?

Generally, we are sending only one copy of the proxy materials to eligible stockholders who share a single address unless we received instructions to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. We will promptly deliver a separate copy of proxy materials to any stockholder who requests one by contacting our corporate secretary by telephone at (507) 535-1205, or by mail to our principal executive offices at 1016 Civic Center Drive N.W., Rochester, Minnesota 55901, Attention: Corporate Secretary. If you are a registered stockholder residing at an address with another registered stockholder and you wish to receive a separate proxy in the future, or if the registered stockholders at that address currently are receiving multiple copies of the proxy materials and you wish to receive a single copy, you may contact our corporate secretary at the telephone number or address set forth above. If you are a stockholder whose shares are held by a bank, broker or other nominee, you can request information about householding from your bank, broker or other nominee.

PROPOSAL 1 FORWARD-LOOKING STATEMENTS– ELECTION OF DIRECTORS

Certain statements contained in this proxy statement may constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. These statements are often identified by such forward-looking terminology as “expect,” “intend,” “look,” “believe,” “anticipate,” “estimate,” “project,” “seek,” “may,” “will,” “would,” “could,” “should,” “trend,” “target,” and “goal” or similar statements or variations of such terms and include, but are not limited to, those relating to our expectations for core capital and our strategies and potential strategies for improvement thereof; our possible future business and financing needs; and any other statements, projections or assumptions that are not historical facts. Factors that may cause actual results to differ from our assumptions and expectations include those set forth in our most recent filings on Forms 10-K and 10-Q with the Securities and Exchange Commission. All forward-looking statements are qualified by, and should be considered in conjunction with, such cautionary statements. For additional discussion of the risks and uncertainties applicable to us, see the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2015.

PROPOSAL 1 - ELECTION OF DIRECTORS

Background

Our certificate of incorporation, as amended, provides that the board of directors shall fix the number of directors from time to time. The size of the board has been set at nine members, subject to the power of the board to increasechange the size of the board at any time. Proxies solicited by this proxy statement relate solely to nominees to our board for election by holders of our common stock and cannot be voted for more persons than the three nominees named below.

The board members to be elected by the holders of common stock are divided into three classes. The terms of three members of the board, Mr. Fogarty,Krehbiel, Dr. Smith and Mr. McDonald, and Dr. Shannon,Utz, will expire at the conclusion of the annual meeting. Mr. Fogarty and Mr. McDonald will each have completed their fourth three-year term and, therefore, will have reached board term limits as defined in our by-laws. The board has nominated Mr. Krehbiel, Dr. Shannon, aSmith and Mr. Utz, all of whom are current membermembers of the board of directors, whose current term will expire at the conclusion of the meeting, and Michael Bue and Hans Zietlow, for election as directors to serve terms to expire at the conclusion of the third succeeding annual meeting of stockholders after their election, with each to hold office following each nominee’s election and qualification until his or her successor has been duly been elected and qualified. Mr. Bue and Mr. Zietlow were recommended to the nominating and governance committee by the non-management director members of that committee and were evaluated along with other potential director nominees. It is intended that the proxies solicited on behalf of the board (other than proxies reflecting votes against or abstentions as to one or more nominees) will be voted at the meeting for the election of the nominees identified in this paragraph. If any nominee is unable to serve, the shares of common stock represented by all of these proxies will be voted for the election of a substitute as the board may recommend.

The board knows of no reason why any of the nominees, if elected, might be unable to serve. Except as described herein, there are no arrangements or understandings between any director or nominee and any other person pursuant to which the director or nominee was selected.

Selection of Director Nominees

Director Qualifications. The board, acting through the governance and nominating committee, is responsible for selecting director nominees. The board and the governance and nominating committee believe that the board as a whole and its members individually should possess a combination of skills, professional experience, and business judgment necessary to oversee our company’s current and future operations and represent stockholders’ interests. The attributes that the board believes every director nominee should possess include:

notable or significant business or public service achievement and experience;

familiarity with, knowledge of, or experience in, the commercial banking industry;

familiarity with, knowledge of, or experience in, managing risk;

the highest character and integrity;

knowledge and understanding of the business and social environment in the primary geographical areas in which we operate;

an understanding of their obligation to represent the interests of all shareholders;stockholders;

freedom from conflicts of interest that would interfere with their ability to discharge their duties or that would violate any applicable laws or regulations;

capability of working in a collegial manner with persons of diverse educational, business and cultural backgrounds; and

ability to devote the necessary time to discharge their duties, taking into account memberships on other boards and other responsibilities.

Procedures Regarding Director Candidates Recommended by Stockholders. As set forth in its charter, the governance and nominating committee will consider director candidates recommended by stockholders if the recommended director candidate would be eligible to serve as a director under our by-laws. Our by-laws require that directors have their primary domicile in a county where the bank has a full service branch. This requirement may be waived by a majority of the board so long as a majority of the directors currently serving on the board have their primary domicile in a county where the bank has a full service branch. Our by-laws also require that each director must receive (or have been deemed to receive) any approval, waiver or non-objection required by the company’s and the bank’s federal regulators. This qualification requirement may be waived by a majority of the board in its sole discretion.

In order to be considered by the governance and nominating committee, a stockholder recommendation of a director candidate must set forth all information relating to the candidate that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required pursuant to Regulation 14A under the Exchange Act (including the potential director’sdirector’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

The governance and nominating committee will consider director candidates recommended by stockholders in the same manner that it considers all director candidates. This consideration will include an assessment of each candidate’scandidate’s experience, integrity, competence, diversity, skills and dedication in the context of the needs of the board. Each candidate will be evaluated in the context of the board as a whole, with the objective of recommending a group of nominees that can best perpetuate the success of the business and represent stockholder interest through the exercise of sound judgment based on a diversity of experience.

Rather than recommending director candidates to the governance and nominating committee, stockholders may directly nominate a person for election to the board by complying with the procedures set forth in our by-laws, any applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and any other applicable laws. For more information regarding the submission of stockholder nominations of director candidates, please refer to the section entitled “Stockholder Proposals,” as well as the Q&A appearing at the beginning of this proxy statement.

Board Diversity. Neither the governance and nominating committee nor the board has a formal policy with regard to the consideration of diversity in identifying director nominees. However, the governance and nominating committee considers diversity on the board in evaluating potential director nominees and believes that diverse perspectives are represented on the board, within the constraints of our by-law requirement that generally directors must have their primary domicile in a county where the bank has a full service branch.

Board of Directors

The following table sets forth certain information regarding each director or director nominee:

Name | Age | Position | Director | Age | Position | Director | ||||||

Nominated for Election: | ||||||||||||

Nominated for Reelection for term expiring in 2021: | ||||||||||||

Bradley C. Krehbiel | 59 | Director; President/CEO of the company and the bank | 2009 | |||||||||

Hugh C. Smith | 78 | Chairman and Director | 2009 | |||||||||

Mark E. Utz | 57 | Director | 2012 | |||||||||

Term expiring in 2019: | ||||||||||||

Michael A. Bue | 70 | Nominee | N/A | 72 | Director | 2016 | ||||||

Wendy S. Shannon | 62 | Director | 2013 | 64 | Director | 2013 | ||||||

Hans K. Zietlow | 55 | Nominee | N/A | 57 | Director | 2016 | ||||||

Term expiring in 2016: | ||||||||||||

Michael J. Fogarty | 77 | Director | 2002 | |||||||||

Malcolm W. McDonald | 79 | Director | 2004 | |||||||||

Wendy S. Shannon | 62 | Director | 2013 | |||||||||

Term expiring in 2020: | ||||||||||||

Allen J. Berning | 63 | Director | 2011 | |||||||||

Bernard R. Nigon | 69 | Director | 2011 | |||||||||

Patricia S. Simmons | 66 | Director | 2015 | |||||||||

Term expiring in 2017: | ||||||||||||

Allen J. Berning | 61 | Director | 2011 | |||||||||

Patricia S. Simmons | 64 | Director | 2015 | |||||||||

Bernie R. Nigon | 67 | Director | 2011 | |||||||||

Term expiring in 2018: | ||||||||||||

Bradley C. Krehbiel | 57 | President and Director of the company and the bank | 2009 | |||||||||

Hugh C. Smith | 76 | Chairman and Director | 2009 | |||||||||

Mark E. Utz | 55 | Director | 2012 | |||||||||

Allen J. Berning has been a director of the company since 2011. Mr.Berning is currently CEOserved as Chief Executive Officer of Ambient Clinical Analytics, which offers a suite of analytics based clinical decision support products.products, since 2014. From 2012 to 2014, Mr. Berning worked as an independent consultant in the medical technology and electronics industries. From 2007 until 2012, Mr. Berning was the Chief Executive Officer of Hardcore Computer, Inc., a computer design and manufacturing company. Prior to joining Hardcore Computer in 2007, Mr. Berning served as Chairman and Chief Executive Officer of Pemstar, Inc., an engineering and medical device manufacturing company, since founding the company in 1994. Prior to 1994, he held various engineering and management positions throughout his 15 year career with IBM.

Mr. Berning, havingwho founded Pemstar and serving as its Chief Executive Officer for 13 years, then servinghas served as the Chief Executive Officerchief executive officer of Hardcore Computercompanies for over 4 years, and now serving as CEO of Ambient Clinical Analytics,two decades, brings extensive experience and perspective to our board, assisting it in assessing risk, evaluating opportunities and identifying resources essential to our success. Mr. Berning has resided in the Rochester, Minnesota area for more than 30 years, providing him with an understanding and appreciation for the business and social atmosphere of the bank’s largest market.

Michael A. Bue is a nominee for election as a director at the 2016 annual meeting of stockholders. Mr. Bue is currently retired. Mr. Bue most recently served in a consulting capacity to a variety of community banks. Prior to that, Mr. Bue was the President and Chief Executive Officer of Security State Bank of Lewiston, a commercial bank in Lewiston, Minnesota, from 2008 until 2011. In addition, Mr. Bue served as a Market President and then the Senior Vice President and Corporate Director of Business Banking for First Federal Capital Bank from 2002 to 2004, was the President and Chief Executive Officer of Marquette Bank Rochester, a commercial bank, from 1995 to 2002, and was the President and Chief Executive Officer of St. Cloud National Bank and Trust Co, St. Cloud, Minnesota, from 1985 to 1995. Mr. Bue previously served as a member of the Board of Directors of the Rochester Area Community Foundation, the Rochester Area Chamber of Commerce, the Gamehaven Council of the Boy Scouts of America and Rochester Economic Development Inc.

Mr. Bue has over 40 years of practice in the financial service industry. He will bringindustry and brings extensive experience in executive bank management and credit administration to the board. In addition, Mr. Bue’s many years in a variety of community bank settings gives him a unique understanding and perspective of community banking for the board and the company. Mr. Bue has been an active leader in the Rochester, Minnesota community and brings to the board a strong appreciation of that community’s strengths, its leaders and the opportunities the market provides for the company.

Michael J. Fogarty has been a director of the company since 2002.In a career spanning over 40 years, Mr. Fogarty has served the C.O. Brown Insurance Agency, located in Rochester Minnesota, as an owner, CEO and Chairman of the Board of Directors. After the sale of the C.O. Brown Insurance Agency in 2006, Mr. Fogarty remained on staff as an insurance agent and Vice President until his retirement on January 1, 2015. Mr. Fogarty previously served as a member of the Board of Directors of Midwest Specialized Transportation and as a member of the Board of Directors of the Reading Center in Rochester, Minnesota. He served in a fund raising capacity for the Reading Center for several years and he continues to raise funds for the organization as a volunteer fundraiser and speaker on behalf of the organization.

Mr. Fogarty was a member and participated in the Independent Insurance Agents Organization, both state and national, the Agent’s Advisory Committee of Great West Insurance Company, and the Agent’s Advisory Committee of CNA Insurance Company.Mr. Fogarty brings to our board extensive business experience from selling risk protection and financial products, which provides our board with perspective in its oversight of the company’s financial services business. Mr. Fogarty’s experience with risk protection products also assists our board in its identification and oversight of company risks. Mr. Fogarty’s 13 years of experience on our board has given him insight into, and perspective on, our company’s operations, which assists our board in its oversight of our company.

Bradley C. Krehbielhas been a director of the company since 2009, President of the company since 2010 and the President of the bank since 2009. He has also served as the Chief Executive Officer of the bank and the company since 2012. Prior to that, he had been the Executive Vice President of the bank since 2004. Mr. Krehbiel joined the bank as Vice President of Business Banking in 1998. Prior to his employment at the bank, Mr. Krehbiel held several positions in the financial services industry. Mr. Krehbiel is also currently a member of the Board of Directors of the Rochester Symphony Orchestra & Chorale.

Mr. Krehbiel brings to our board the financial services industry insights and perspectives gained through his extensive financial services industry experience. In addition, as an executive of our banking subsidiary for over sixteen16 years, Mr. Krehbiel contributes a unique understanding of, and perspective on, our banking operations to our board.

Malcolm W. McDonald has been a director of the company since 2004. Mr. McDonaldserved as a member of the Board of Directors and Senior Vice President of Investments of Space Center, Inc., an industrial real estate firm located in St. Paul, Minnesota, from 1977 until his retirement in 2003. From 1960 to 1977, Mr. McDonald served as a Vice President and Division Head in Lending, followed by Vice President in Investment Services, of the First National Bank of Saint Paul. He is a director or trustee of several nonprofit foundations and organization, including a member and Vice Chair of the Investment Advisory Council of the Minnesota State Board of Investment, director and executive committee member of the Minnesota Center for Fiscal Excellence, vice president and trustee of the Grotto Foundation, director and executive committee member of the Minnesota Independent School Forum, emeritus and director of Way to Grow, Inc., Trustee Emeritus of the Amherst H. Wilder Foundation, member of the Emeritus Council of the Minnesota Historical Society, director of the Afton Historical Society Press, director of Starbase Minnesota, Inc., and Emeritus Trustee of the Minnesota State Fair Foundation. In addition, Mr. McDonald has served on the boards of directors of the Guthrie Theatre, Minnesota Orchestra, Minnesota Chamber of Commerce, St. Paul Chamber of Commerce, Minnesota Zoo, and the Bigelow Foundation. Mr. McDonald was also a member of the Board of Directors of Scherer Brothers Lumber Company, a privately held full-service lumber yard. From 1974 to 1994, he was an Adjunct Professor at the University of St. Thomas Graduate Program of Management in St. Paul, Minnesota.

Based on his 42-year career in financial services management and commercial real estate, Mr. McDonald brings to our board extensive knowledge and experience in lending, investing and audit functions, as well as a deep understanding of the importance of the role of banking in a community. Based on his service on numerous public-company, private-company and nonprofit boards of directors, Mr. McDonald also brings to our board his extensive understanding of corporate governance, including board committee structures and executive succession planning, as well as significant experience in risk oversight.

Bernard R. Nigon has been a director of the company since 2011.is currently retired. From 1985 until his retirement in 2010, he was an audit partner with RSM US LLP (formerly McGladrey & Pullen, LLP.LLP). He began his career with McGladrey & Pullen, LLP in 1975. He is aan inactive Certified Public Accountant and a member of the American Institute of Certified Public Accountants and the Minnesota Society of Certified Public Accountants. Mr. Nigon is also currently a member of the board of directors of the History Center of Olmsted County and the Hiawatha Chapter of Trout Unlimited.

Mr. Nigon has extensive accounting and financial reporting experience, having practiced with a national accounting firm and examined the financial records of both public and private companies for over 35 years. His experience and expertise assists the board in understanding and addressing complex accounting and financial reporting issues.

Wendy WendyS.Shannon has been a directorserved as the chair of the companyRochester Education Department at Winona State University since 2013. Dr. Shannon2015 and as Director of the Graduate Induction Program of Rochester Public Schools since 2012. She has been an assistant professor of education at Winona State University since August 2012. She is the former Superintendent of the Byron School District, a position she held from 1999 to 2012. Prior to 1999, Dr. Shannon served as the Executive Director of the Zumbro Education District; Management Development Specialist, Minnesota Department of Transportation; Facilitator for Minnesota Educational Effectiveness Program, Director Principal Leadership Program; and a secondary education teacher. Dr. Shannon is a member and VicePast Chair of the Board of Directors of the Rochester Area Foundation, former member of the Board of Trustees of Olmsted Medical Center, memberformer Chair and former Chairmember of the United Way of Olmsted County, Chair of the Chancellor’s Advisory and Advocacy Committee, University of Minnesota, Rochester, and a member of the Board of Directors of the Poverello Foundation.

Dr. Shannon has 40 years of extensive experience as a leader in nonprofit, government and education settings in the Rochester area. She has management, process, strategic planning and human resource skills that contribute to strengthening organizations and the community.

Patricia PatriciaS.Simmons has been a director of the company since 2015.is currently retired. Dr. Simmons was a member of the Mayo Clinic medical staff from 1983 until her retirement in 2014. During the course of her tenure at Mayo Clinic she served in numerous capacities, including as Professor of Pediatric and Adolescent Medicine, Chair-Division of Pediatric and Adolescent Gynecology, Chair of the Board – Mayo Medical Ventures, Member – Mayo Clinic Board of Governors, Mayo Clinic Executive Committee, and Mayo Clinic Board of Trustees, as well as other executive and administrative positions. Dr. Simmons has been twice elected to the University of Minnesota Board of Regents by a unanimous vote of the Joint Legislative Sessions of the Minnesota House and Senate, and was elected for a third term in 2015. She chaired the University Board of Regents upon election by her peers. Dr. Simmons currently serves on the Boards of the Hill Museum and Manuscript Library of Saint John’s University, Catalyst of the Bill and Penny George Family Foundation, Minnesota Public Radio and American Public Media, and the Guthrie Theater.Media. She has recently participated as a member of the board of a number of business organizations, including the Minnesota Chamber of Commerce, the Minnesota Business Partnership, and Greater MSP.MSP, and non-profit institutions including the Guthrie Theater.

Dr. Simmons brings extensive executive and administrative skills to theour board, of the company, having served in various capacities inon business, not-for-profit, educational and professional society boards. Her commitment to the development of southeastern Minnesota and Rochester was most recently demonstrated by her activities as President and Chair of the Economic Development Agency of the Destination Medical Center initiative. Dr. Simmons also brings to the board extensive experience in governance and a broad understanding of the assessment of risk and approaches to mitigate risk in a wide range of endeavors. Dr. Simmons has been an active leader in the Rochester community as well as the State of Minnesota, and brings an appreciation of that community’s strengths to the board.

Hugh C. Smith has been a director of the company since 2009. Dr. Smith was a member of the Mayo Clinic medical staff from 1972 until his retirement in 2007. During thisthat time he served in various capacities, including as Professor of Medicine, Mayo Clinic College of Medicine, a medical school, and Chair, Cardiovascular Division at Mayo Clinic, a full-service, not-for-profit medical practice. Dr. Smith also served as Chief Executive Officer and Chair of the Finance Committee, Mayo Clinic-Rochester, from 1999 through 2006; Vice President, Mayo Foundation, 2002 through 2006; and Chair, Rochester Board of Governors, Mayo Clinic, 1999 through 2006. Dr. Smith previously served eight years as a member of the Board of Directors of Dartmouth Hitchcock Medical Center, and is a member of the Board of Directors, chair of the Governance Committee and member of the Human Resources/Compensation and Audit Committees of Blue Cross Blue Shield Minnesota, and is a member of the Board of Directors and Chair of the Rochester Area Foundation.Minnesota. He completed his terms as a member of the Board of Directors of Hormel Foods Corporation in November 2011 and as a member of the Board of Directors and Chair of the Rochester Area Foundation in 2016. Dr. Smith joined the Chancellor’s Advisory and Advocacy Committee, University of Minnesota, Rochester in 2013.

Dr. Smith brings extensive executive management experience to our board, having served as a Chief Executive Officer directing more than 2,000 physicians and scientists and over 35,000 employees. Based on his service on public company and non-profit boards of directors, Dr. Smith also brings to our board his extensive understanding of corporate governance and significant experience in risk oversight. Dr. Smith is active in the Rochester, Minnesota community and brings to our board a strong understanding of that community, its leaders, its financial services needs and its exposure to economic risks.

Mark E. Utz has been a director of the company since 2012. Since 1991, Mr. Utz has been an attorney at Wendland Utz, Ltd. (“Wendland Utz”) since 1991, where he advises clients on business, real estate and estate planning matters. Mr. Utzmatters and is thealso President and a shareholder of Wendland Utz.shareholder. Prior to 1991, he was an attorney in the tax department at Arthur Andersen in Chicago. He is a Board Certified Real Property Law Specialist, which is a certification issued by the Minnesota State Bar Association. Mr. Utz is a member of the Board of DirectorsTrustees of the Rochester Area Foundation (Chair), Rochester Area Economic Development, Inc. (Past Chair), the Greater Rochester Advocates for Universities and Colleges (Current(Past Chair), the Minnesota Zoo, the Chancellor’s Advisory and Advocacy Committee, University of Minnesota Rochester and serves as the Chair of the Rochester Area Chamber of Commerce Government Forums Committee. Mr. Utz is a past member of the Board of Directors of the Rochester Public Utilities, the Rochester Area Chamber of Commerce, the Rochester Rotary Risers (Past President), the Rochester Area Builders Association (Past Governmental Affairs Chair), the Ronald McDonald House of Rochester (Past President), and the Estate Planning Council of Rochester, Minnesota (Past Chair).

Mr. Utz has extensive experience in counseling clients on a number of legal issues, including those related to corporate and real estate matters through his practice as an attorney for over 25 years. His experience and expertise assistsassist the board in understanding and addressing corporate law and corporate governance issues that impact us.the company. Mr. Utz is active in the Rochester, Minnesota community and brings to our board a strong understanding of that community, its leaders, its financial services needs and its exposure to economic risks.

Hans K. Zietlow is a nominee for electionhas served as a director at the 2016 annual meeting of stockholders. Mr. Zietlow is the Director of Real Estate for Kwik Trip, Inc. retail convenience stores, which consistsconsist of over 475510 sites in Minnesota, Wisconsin and Iowa.Iowa, since 2002. In that role, Mr. Zietlow has overseen the development of all Kwik Trip real estate since 2002. Since 2003, Mr. Zietlow has also been the Director of Development for 3 Northwest Investments, a real estate development firm. Mr. Zietlow has been in sales for Northwest Realty, Inc., a real estate brokerage, since 2004.

Mr. Zietlow has 1718 years of senior executive experience in the evaluation, execution and acquisition of commercial real estate development and growth strategies. Mr. Zietlow will bringbrings to our board a keen industry knowledge of intrastate and interstate business, operations, and collaboration with multiple local governmental tribunals as well as an understanding of successful real estate growth strategies.

The board recommends that stockholders votefor the electionof the three candidates

nominated for election as indicatedabove.

PROPOSAL 2 -– ADVISORY (NON-BINDING) VOTE ON EXECUTIVE COMPENSATION

In accordance with Section 14A of the Exchange Act, stockholders are being given the opportunity to vote to approve, on an advisory, non-binding basis, the compensation of our executives, as disclosed in this proxy statement, including the information presented under the heading “2015“2017 Executive Compensation.”

This is an advisory vote only, and neither the company nor our board of directors will be bound to take action based upon the outcome. While the vote is advisory, the compensation committee will consider the vote of the stockholders when considering future executive compensation arrangements.

We are presenting this proposal, which gives you as a stockholder the opportunity to vote to approve our executive officer compensation as disclosed in this proxy statement by voting for or against the following resolution:

“RESOLVED, that the stockholders approve, on an advisory basis, the compensation of the company’scompany’s named executive officers as disclosed in the proxy statement for the 20162018 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission,SEC, including the 20152017 Summary Compensation Table and the other compensation tables and narrative disclosure.disclosure.”

The board recommends that stockholders votefor the approval of the compensation awarded to the executives, as disclosed in this proxy statement.

We currently hold our say-on-pay vote every year. Stockholders will have an opportunity to cast an advisory vote on the frequency of say-on-pay votes at least every six years. The next advisory vote on the frequency of the say-on-pay vote will occur no later than 2019.

PROPOSAL 3 – RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon the recommendation of the audit committee, the board of directors has appointed CliftonLarsonAllen LLP, an independent registered public accounting firm, to be our independent registered public accounting firm for 2016,2018, subject to ratification by the stockholders. CliftonLarsonAllen LLP has audited the financial statements of our company and the bank since 2014. Representatives of CliftonLarsonAllen LLP are expected to attend the meeting to respond to appropriate questions and to make a statement, if they so desire.

In connection with the engagement of CliftonLarsonAllen LLP, we entered into an engagement agreement with CliftonLarsonAllen LLP on March 6, 2015 that sets forth the terms pursuant to which CliftonLarsonAllen LLP will perform its audit services. That agreement is subject to alternative dispute resolution procedures and an exclusion of punitive damages.

While it is not required to do so, the audit committee is submitting the appointment of CliftonLarsonAllen LLP for ratification in order to ascertain the view of the stockholders. If the stockholders do not ratify the appointment, the audit committee will review the appointment.

The board recommends that stockholders votefor the ratification of

the appointment of CliftonLarsonAllen LLP as our 2016 2018independent registered public accounting firm.

CORPORATE GOVERNANCE

Board Leadership Structure and Role in Risk Oversight

The board of directors is committed to its role in providing objective risk oversight of the company. The structure and responsibilities of the board’sboard’s membership, leadership and committees is a critical aspect of our corporate governance to fulfill this role.

The company’scompany’s corporate governance guidelines require that a substantial majority of the board shall be “independent directors”directors,” and the board believes its process of selecting and nominating a diverse membership with a combination of skills, professional experience and business judgment is an important element in accomplishing its risk oversight responsibility. The board does not have a policy on separating the offices of Chairman of the Board and Chief Executive Officer since it believes it should be free to make the choice from time to time that is in the best interests of the company and its stockholders. While there is no policy, it is the current practice of the board to have the Chairman be an independent board member. Currently, Dr. Smith serves as the Chairman of the Board and Mr. Krehbiel serves as President and Chief Executive Officer and President of the company and the bank and as aour director. The board believes this is the most appropriate structure for the company at this time and contributes to objective risk oversight because it makes use of Dr. Smith’s experience on our board and his extensive understanding of corporate governance and risk oversight that he developed from his service on public company and non-profit boards of directors, while freeing Mr. Krehbiel to focus his energies on the operations of the company and the bank.

The chairs of board committees are selected by the full board based on their experience and expertise, including consideration of their understanding of the risk oversight associated with their respective committee. The board of directors and the audit, compensation and nominatinggovernance and governancenominating committees of the board coordinate with each other, through the leadership of Dr. Smith and the committee chairs, to provide enterprise-wide risk oversight of management and the company’s operations. Our committees address risk-related matters during their meetings and the committee chairs regularly report to the full board on risk-related matters, providing the full board with integrated insight about our management of strategic, credit, interest rate, financial reporting, technology, liquidity, compliance, operational and reputational risks. In addition, our banking subsidiary has its own board of directors and audit, loan, information technology, compliance and asset/liability management committees whose responsibilities include risk management for the bank. The management and committees of our banking subsidiary also provide reports to our board of directors regarding activities related to risk management.

At meetings of the board of directors and its committees, directors receive regular updates from management regarding risk management. The chief financial officer, chief operating officer and other senior management of our banking subsidiary, who are responsible for instituting risk management practices that are consistent with our overall business strategy and risk tolerance, report directly to Mr. Krehbiel and lead management’s risk discussions at board and committee meetings. Outside of formal meetings, the board, its committees and individual board members have full access to senior executives and management for, among other purposes, discussions of risks facing our company and the management of those risks.

Committees of the Board of Directors

The board of directors has standing audit, compensation,compensation, executive and governance and nominating committees. The directors’ current committee memberships are indicated in the following table:

Director | Audit Committee | Compensation | Executive | Governance | ||||

Allen J. Berning | - | Member | Alternate | Chair | ||||

Michael | Member | - | Alternate |

| ||||

Bradley C. Krehbiel | - | - | Member | - | ||||

|

|

|

|

| ||||

Bernard R. Nigon | Chair | - | Alternate | - | ||||

Wendy S. Shannon |

| Chair | Alternate | - | ||||

Patricia S. Simmons | - | Member | Alternate |

| ||||

Hugh C. Smith |

| Member | Member | - | ||||

Mark E. Utz | - | Member | Alternate | Member | ||||

Hans K. Zietlow | - | - | Alternate | Member |

* Mr. Fogarty and Mr. McDonald will each have reached board term limits as defined in our by-laws and will be replaced following the election of directors at our annual meeting.

Audit Committee. The audit committee oversees our financial reporting process by, among other things, recommending and taking action to oversee the independence of the independent registered public accounting firm and selecting and appointing the independent registered public accounting firm. The board has determined that all members of the audit committee are independent as that term is defined in the applicable NASDAQNasdaq listing standards and regulations of the Securities and Exchange CommissionSEC and that all members are financially literate as required by the applicable NASDAQNasdaq listing standards. In addition, the board has determined that Mr. Nigon has the financial experience required by the applicable NASDAQNasdaq listing standards and is an audit committee financial expert as defined by applicable regulations of the Securities and Exchange Commission.SEC. The responsibilities of the audit committee are set forth in the audit committee charter, which is available on our website at www.hmnf.com. The audit committee reviews and reassesses its charter annually.

Compensation Committee. The compensation committee oversees and administers the compensation and benefits programs for executive officers and directors, including our 20092017 Equity Incentive Plan, and reviews and reports to the board on matters concerning compensation plans and the compensation of certain executives. The board has determined that all members of the compensation committee are independent as that term is defined in the applicable NASDAQNasdaq listing standards. The responsibilities of the compensation committee are set forth in the compensation committee charter, a copy of which is available on our website at www.hmnf.com. The compensation committee reviews and reassesses its charter annually.

The compensation committee has the full authority to determine all elements of the compensation for Mr. Krehbiel and to approve all elements of the compensation of our other executive officers. In approving compensation actions for the other executive officers, the compensation committee receives regular input and recommendations from Mr. Krehbiel, and ascribes significant weight to his recommendations. Our chief financial officer and his staff, together with outside professionals, assist the compensation committee in evaluating the financial, accounting and tax treatment of existing and potential elements of our executive compensation program.

The compensation committee has the authority to retain independent compensation consultants to assist in the evaluation of executive officer compensation, and since 2010 has engaged Blanchard Consulting Group as its independent compensation consultant. Blanchard Consulting Group assists the compensation committee in refining the committee’s compensation philosophy, defining characteristics of peer financial institutions and identifying particular peer group entities, compiling peer group compensation data, analyzing the elements of compensation, developing incentive compensation systems and ensuring compliance with regulatory requirements. The compensation committee has assessed the independence of Blanchard Consulting Group pursuant to the rules of the SEC and concluded that no conflict of interest exists that would prevent Blanchard Consulting Group from independently advising the compensation committee.

Executive Committee. The executive committee acts on issues arising between regular board meetings. The executive committee possesses the powers of the full board between meetings of the board.

Governance and Nominating Committee. The governance and nominating committee selects candidates as nominees for election as directors and advises and makes recommendations to the board on other matters concerning directorship and corporate governance practices, including succession plans for our executive officers. The board has determined that all members of the governance and nominating committee are independent as that term is defined in the applicable NASDAQNasdaq listing standards. The responsibilities of the governance and nominating committee are set forth in the governance and nominating committee charter, which is available on our website at www.hmnf.com. The governance and nominating committee reviews and reassesses its charter annually.

Board and Committee Meetings

The boardboard held 10nine meetings during 2015.2017. The audit committee held 5five meetings during 2015.2017. The compensation committee held 5five meetings during 2015. The executive committee held no meetings during 2015.2017. The governance and nominating committee held 6three meetings during 2015.2017. The executive committee did not meet during 2017. Each of our directors attended at least 75% of the meetings of the board and all committees on which the director served.served, except Hans Zietlow attended 67% of such meetings.

Director Independence

The board has determined that none of our directors (except(except for Mr. Krehbiel, who is an employee of the bank) or director nominees have a material relationship with our company other than service as a director (either directly or as a partner, stockholder or officer of an organization that has a material relationship with our company). Mr. Utz is the presidentPresident and a shareholder of more than a 10% equity interest in Wendland Utz, which provided certain legal services to the company over the past few years. We concluded that the services provided by Mr. Utz did not impact his independence under the applicable NASDAQNasdaq listing standards due to the totalde minimis amount of fees paid by the company to Wendland Utz. As discussed in more detail under “Certain Transactions” below, certain of our directors have loans with the bank. The board concluded that such loans did not impact the independence of any of the directors or director nominees under the applicable NASDAQNasdaq listing standards. Therefore, each of Messrs. Berning, Bue, Fogarty, McDonald, Nigon, Utz, and Zietlow and Drs. Shannon, Simmons and Smith is independent within the meaning of applicable NASDAQNasdaq listing standards.

Code of Business Conduct and Ethics

We adopted a Code of Business Conduct and Ethics applicable to all of our directors and employees, including our senior management and financial reporting employees. This codecode is available on our website at www.hmnf.com.

Stockholder Communication with the Board

The board of directors provides a process for stockholders to send communications to the board or any of the directors. Stockholders may send written communications to the board or any of the directors c/o Chief Financial Officer, HMN Financial, Inc., 1016 Civic Center Drive N.W., Rochester, Minnesota 55901. All communications will be compiled by the Chief Financial Officer and submitted to the board or the individual directors on a periodic basis. Communications directed to the board in general will be forwarded to the appropriate director(s) to address the matter.

Director Attendance at Annual Meetings

Directors are expected to attend the annual meeting of stockholders. In 2015, all2017, eight of our directors attended the annual meeting of stockholders.

Stockholder Proposals

Under our by-laws, certain procedures are provided that a stockholder must follow to introduce an item of business at an annual meeting of stockholders or to nominate persons for election as directors. These procedures provide, generally, that stockholders desiring to bring a proper subject of business before the meeting, or to make nominations for directors, must do so by a written notice received by our corporate secretary, containing the name and address of the stockholder as they appear on our books and the class and number of shares owned by the stockholder, not later than 90 days in advance of the meeting (or if we do not publicly announce our annual meeting date 100 days in advance of the meeting date, by the close of business on the 10th10th day following the day on which notice of the meeting is mailed to stockholders or publicly made) by our corporate secretary containing the name and address of the stockholder as they appear on our books and the class and number of shares owned by the stockholder.. If the notice relates to an item of business it also must include a representation that the stockholder intends to appear in person or by proxy at the meeting. Notice of an item of business shall include a brief description of the proposed business and a description of all arrangements or understandings between the stockholder and any other person or persons (including their names) in connection with the proposal of business by the stockholder and any material interest of the stockholder in the business. If the notice relates to a nomination for director, it must set forth the name and address of any nominee(s), any other information regarding each nominee as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange CommissionSEC had each nominee been nominated by the board, and the consent of each nominee to be named in the proxy statement and to serve on the board.

The chairman of the meeting may refuse to allow the transaction of any business not presented, or to acknowledge the nomination of any person not made, in compliance with the foregoing procedures. Copies of our by-laws are available from our corporate secretary.

Related Person Transaction Approval Policy

Our board of directors has adopted a written policy for related person transactions, which sets forth our policies and procedures for the review, approval or ratification of transactions subject to the policy with related persons who are subject to the policy. Our policy applies to any transaction, arrangement or relationship or any series of similar transactions, arrangements or relationships that have a financial aspect and in which we are a participant and a related person has a direct or indirect interest. Our policy, however, exempts the following:

our payment of compensation to a related person for that person’s service to us in the capacities that give rise to the person’s status as a “related person”;

transactions available to all of our employees or all of our stockholders on the same terms;

any extension of credit by our banking subsidiary in which a related person has a direct or indirect interest and which complies with the requirements of Regulation O under Title 12 of the Code of Federal Regulations and has been approved by either the board of directors of our banking subsidiary or its loan committee; and

transactions, which when aggregated with the amount of all other transactions between the related person and our company, involve less than $120,000 in a fiscal year.

We consider the following people to be related persons under the policy:

all of our executive officers and directors;

any nominee for director;

any immediate family member of any of our directors, nominees for director or executive officers; and

any holder of more than 5% of our common stock, or an immediate family member of the holder.

The audit committee of our board of directors must approve any related person transaction subject to this policy before commencement of the related party transaction.person transaction, except as otherwise provided below. The committee will analyze the following factors, in addition to any other factors the committee deems appropriate, in determining whether to approve a related partyperson transaction:

whether the terms are fair to our company;

whether the transaction is material to our company;

the role the related person has played in arranging the related person transaction;

the structure of the related person transaction; and

the interests of all related persons in the related person transaction.

The committee may, in its sole discretion, approve or deny any related person transaction. Approval of a related partyperson transaction may be conditioned upon our company and the related person taking any actions that the committee deems appropriate.

If one of our executive officers becomes aware of a related person transaction that has not previously been approved under the policy:

if the transaction is pending or ongoing, it will be submitted to the audit committee promptly and the committee will consider the transaction in light of the standards of approval listed above. Based on this evaluation, the committee will consider all options, including approval, ratification, amendment, denial or termination of the related person transaction; and

if the transaction is completed, the committee will evaluate the transaction in accordance with the same standards to determine whether rescission of the transaction is appropriate and feasible.

There were no related person transactions in 20152017 required to be reported in this proxy statement.

Certain Transactions

The bank follows a policy of granting loans (including overdraft protection features on checking accounts) to eligible directors, officers, employees and members of their immediate families for the financing of their personal residences and for consumer purposes. As of December 31, 2015,2017, the aggregate amount of the bank’s loans to directors, executive officers and affiliates of directors or executive officers was approximately $2.7$0.1 million, or 3.9%0.1%, of our stockholders’ equity. All of these loans were current as of December 31, 2015. For the period beginning January 1, 2015,2017. During 2017, all of the loans to directors and executive officers (i) were made in the ordinary course of business, (ii) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons not related to us or the bank, and (iii) did not involve more than the normal risk of collectability or other unfavorable features.

Independent RegisteredRegistered Public Accounting Firm Feess

The following table presents fees for professional audit and other services rendered by CliftonLarsonAllen LLP for the audit of our annual financial statements for 20152017 and 2014,2016, and fees for other services rendered by CliftonLarsonAllen LLP relating to these fiscal years.

Description of Fees | 2015 | 2014 | 2017 | 2016 | ||||||||||||

Audit Fees(1) | $ | 164,925 | $ | 140,250 | $ | 151,800 | $ | 156,600 | ||||||||

Audit-Related Fees(2) | 40,205 | 37,400 | 43,080 | 43,010 | ||||||||||||

Other Fees(3) | 9,376 | 14,996 | ||||||||||||||

All Other Fees(3) | 10,372 | 13,266 | ||||||||||||||

Total Audit, Audit-Related, and Other Fees | $ | 214,506 | $ | 192,646 | $ | 205,252 | $ | 212,876 | ||||||||

(1) | Audit fees consisted of the annual audit and quarterly reviews of our consolidated financial statements, statutory audit and assistance with and review of documents filed with the |

(2) | Audit-related fees consisted of employee benefit plan audits and audit of compliance with HUD-assisted programs. |

(3) |

|

Approval of Independent Registered Public AccountingAccounting Firm Services and Fees

The audit committee pre-approved 100% of the services provided by CliftonLarsonAllen LLP, our independent registered public accounting firm. CliftonLarsonAllen LLP provided no other services to the company, other than those noted above.

The audit committee’scommittee’s current practice on pre-approval of services performed by the independent registered public accounting firm is to approve annually all audit services and, on a case-by-case basis, recurring permissible non-audit services to be provided by the independent registered public accounting firm during the fiscal year. The audit committee reviews each non-audit service to be provided and assesses the impact of the service on the registered public accounting firm’s independence. In addition, the audit committee may pre-approve other non-audit services during the year on a case-by-case basis. Pursuant to a policy adopted by the audit committee, the chair of the audit committee is authorized to pre-approve certain limited non-audit services described in Section 10A(i)(1)(B) of the Exchange Act. Mr. Nigon, as the chair of the audit committee, did not pre-approve any non-audit services pursuant to this authority in 2015.

Previous Independent Registered Public Accounting Firm2017.

KPMG LLP audited our financial statements for the fiscal years ended December 31, 2013 and 2012. On May 2, 2014, the Audit Committee of the Board of Directors of the Company decided to move forward with a change in its accountants, subject to obtaining an acceptable engagement letter with CliftonLarsonAllen LLP. The Company communicated the Audit Committee’s decision to KPMG on that same date. On May 9, 2014, KPMG confirmed its determination that the client-auditor relationship between the Company and KPMG had ceased. The decision to change accountants was approved by the Audit Committee of the Board of Directors of the Company.

KPMG’s report on the Company’s consolidated financial statements for the years ended December 31, 2013 and 2012 did not contain an adverse opinion or a disclaimer of opinion, nor was any such report qualified or modified as to uncertainty, audit scope, or accounting principles.

During the two fiscal years ended December 31, 2013 and 2012 and the interim period through May 9, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

We have provided KPMG LLP with a copy of the foregoing disclosures as contained in Item 4.01 of our Current Report on Form 8-K filed with the SEC on May 15, 2014 and the amendments thereto dated May 19, 2014 and June 19, 2014, and requested that KPMG LLP furnish a letter addressed to the SEC stating whether it agreed with the above statements made by the company. KPMG indicated that it is not in a position to agree or disagree with the foregoing statements that the change in accountants was (1) subject to obtaining an acceptable engagement letter from the proposed successor firm and (2) approved by the Audit Committee of the Board of Directors. A copy of such letter is filed as Exhibit 16.2 to each amendment to that Current Report on Form 8-K.

During the Company’s two fiscal years ended December 31, 2013 and 2012 and the interim period through May 9, 2014, neither the Company, nor anyone on its behalf, consulted CliftonLarsonAllen LLP regarding (i) the application of accounting principles to a specified transaction, either completed or proposed or the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to the Company by CliftonLarsonAllen LLP that was an important factor considered by the company in reaching a decision as to the accounting, auditing or financial reporting of the company or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K promulgated under the Securities Act of 1933, as amended, and the Exchange Act (“Regulation S-K”) and the related instructions) or a reportable event (as described in Item 304(a)(i)(v) of Regulation S-K).

Report of the Audit Committee